Welcome to Tacs4Expats!

Your Trusted Partner for Property Conveyancing & Tax Services in Costa Blanca

Navigating your legal journey «in» and «from» Spain

At Tax and Consultancy Services for Expats (Tacs4Expats) we specialise in providing comprehensive Tax Advice and Property Conveyancing Services to individuals and self-employed businesses and professionals whether you are Tax Resident in Spain or not.Our focus is on exceptional customer service and the best interests of our clients, guiding you through three key stages:

1) From the moment you decide to make Spain your home – whether it’s obtaining your NIE numbers, opening bank accounts, purchasing property on your behalf, handling Property Conveyancing, Pre-Tax Calculations, and more…

2) While you live in Spain, preparing and filing all your tax returns, setting up your business in Spain, obtainning your Residency Cards, TIE’s or VISA’s, Registering on the Padron at the Town Hall, Social Security, obtainning certificates, Driving Licenses, doing your wills, investing on real estate, buying and selling properties, etc…

3) If you ever decide to move back to your country or your family needs assistance in Spain to change your assets into their name, we will represent you selling your property, closing bank accounts, doing the necessary communications to the Tax Office or completing the Probate for your inheritors.

Some of Our Services

Tax Advice

Our primary goal is understanding your unique situation to provide tailored advice and insights on what needs to be done and why.

We can help you as a Tax Resident or Not Tax Resident filing all your possible tax obligations in Spain.

Income Tax, Wealth Tax, Gift and Inheritance Tax, Transfer Tax (when buying a property), VAT or IVA, Corporate Tax, etc…

We can deal with all of them, help you understand it and making recommendations to reduce them.

Property Conveyancing

Whether you are buying a house to live in or to invest on real estate, or if you are selling your property, it is essential to have an expert on your side working for you.

Our team, guided by Manuel Pérez Manresa, would help you in the whole process to buy a property or sell it.

For individuals like yourself, buying or selling a house is among life’s significant investments. Don’t leave it to chance or unregistered representatives.

Tax Planning

You may think it is need only by very rich people but this is not.

We’ve witnessed cases where a small detail made a difference of tens of thousands of Euros. We analyze your situation and offer recommendations to strategically reduce your tax burden.

Passing your assets to your children on steps, setting values at the time to buy or inherit, making a calendar of gifts, distributing the assets correctly when someone has passed away are examples which can make you save tax in future.

Accountancy for business

We help clients setting up a business, as self employed, as partnership or as limited companies.

It is important helping you understand all the different obligations with the tax office, the Social Security, your Employees, etc.

It does not matter if it is smaller or bigger, we can so it for you.

We can do all the monthly communications to the Social Security if you have employees, Quarterly Returns, Annual Resumes, helping with the rental agreements, obtention of opening licenses, etc.

Electronic Notifications

Public Administrations in Spain are using more and more often this new way to communicate to everyone. For Limited Companies and Businesses it is Obligatory.

There are more than 140 electronic mailboxes and this number increases frecuently.

We can handle all your notifications issued electronically in Spain at local, provincial, regional and national levels to make sure any of them is missed because the letter has not arrived to you or the advice from «Correos» was not on your «buzón».

Tax Returns

Preparing and filing tax returns on certain situations is an obligation even when the income is low.

In some other cases, showing a return submitted is an evidence of the stay which can help to determine your residency.

In case of a Non Tax Resident, if you have a holiday property in Spain, it is obligatory to complete a tax return if you have rental income from it or not.

We can help on all the different situations preparing and filing your tax returns with the Tax Office.

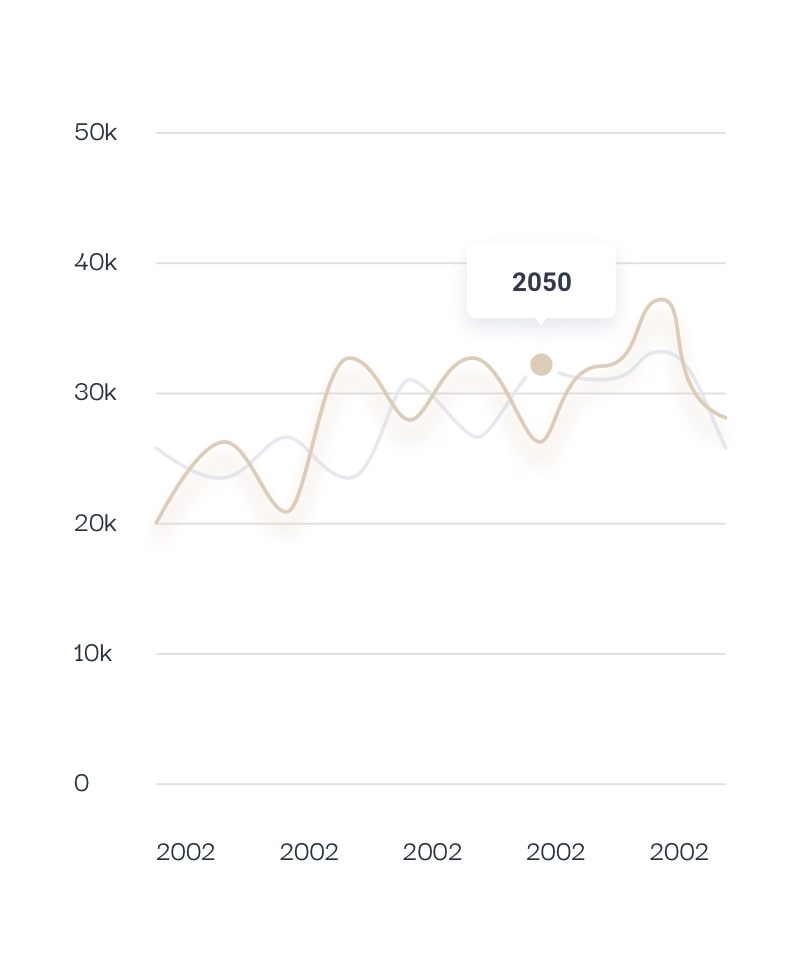

Since 2013, our client base has consistently grown, a testament to the trust our clients place in our services year after year.

We are a team of young professionals with over 10 years of experience working mainly with clients from other countries who have a property, interests, links or a business in Spain.

Different departments help our clients from the most basic things like obtainning an NIE, a Digital Signature, getting registered on the Padron or obtainning a SIP Card, etc… to the most complicated and technical services from the Tax and the Legal point of view trying to make things on the easiest possible way for them.

TAX SERVICES

NEWS

140,990 Million Euros have been declared since 2013

Spanish Residents have declared in total 140,990 Million Euros from 2013 on the Overseas Asset Declaration which started in that year. The Director of the Spanish Tax Office (AEAT), Santiago Menendez, has declared that in 2016, more than 13,755 Million have been...

Tax Office focuses on undeclared Rental Income

The Spanish Tax Office is focusing on the owners of rental properties during 2015. How do they do it? They have collected the information contained on advertisements on different specialized web pages to check with the returns and see if the rental income is...

Inheritance Tax

The Inheritance Tax is one of the most complex personal taxes you may find in Spain as there are 17 different laws to apply depending on the “Comunidad Autónoma” or “Region” where the deceased person has lived more time during the last 5 years. Just to give you a...

PROPERTY CONVEYANCING

Our principal target is the interest of our clients always.

With the increasing demand of Property Conveyancing Services, we offer a full service whether you are selling your property or planning to buy a new one. Even, if you are coming to Spain for the first time, we would help you obtaining your NIE number, Tax Identification Number, opening a bank account, register you and your family on the Town Hall, Tax Office and Social Security and, finally, making the necessary contracts for the utility bills as water, electricity or telephone.

Our team comprises skilled professionals, including Architects, Engineers, and our Solicitor, Manuel Perez Manresa. We’re equipped to handle any property on the market.

- If you are buying a property, we will check the property you are interested in to make sure you know what you are buying and avoid unpleasant surprises in the future as it has happened in the past to some people in Spain. If it is necessary we will make the necessary changes phisically on the property or legally on the deeds before you buy it.

- If you are selling your property, we will provide your Real State Agents and the buyer’s legal representative with all the legal information needed, prepare the reservation contract stating the «rules for the sale», obtain the Energy Performance Certificate, produce the antiquity certificates for any Extension made on the property before the legal date and, in resume, facilitate the sale of your property with legal documents and handling the whole process making it easier and more attractive than others on the market.

What happens if there is an illegal extension on the property I am going to buy? What happens if I there is a debt on the property? Do I need to check for structural damage on a property? What happens if there is moisture, damp or humidity in the house? How do I find out if a property is legal or not? How much do I pay to reserve a property? How much is the deposit to buy a property and when do I pay this? Find all the answers to your questions arranging a meeting with us and make sure you are on the right side of the Laws in Spain in order to avoid problems in future.

We are here to make your life easier so you only have to worry about how to spend your time in Spain

CONVEYANCING

Tax Advice

One of the most important areas to check before moving or changing your Tax Residency to Spain is the Tax Situation in which you would be once you have moved permanently.

At times, clients who have already moved to Spain find themselves with lump sums from pension pots, selling properties that were their main homes for years but are no longer, or receiving various types of income with different tax treatments in Spain and they get frustrated as they did not know in advance.

On these situations there is no solution so we understand it is essential to revise the situation before moving permanently. In case you have already moved but there is something happening in the UK we can recommend ways to reduce your tax liabilities and even strategies to follow in 2 – 3 years which may help minimising the tax impact or even avoiding tax in Spain always within the laws.

Wether you need advice on Income Tax, Wealth Tax, Solidarity Tax, Inheritance Tax, Gift Tax and wherever you are in Spain, we can provide the necessary advise and assistance in order to reduce your tax liabilities and prepare calculations in advance so you know how much it would be the tax to pay under different scenarios.

Is my pension taxable in Spain? If I receive a lump sum, is it taxable in Spain? How much Income Tax do I pay in Spain? Do I pay Tax in Spain or in the UK? If I sell my property in the UK, do I pay any tax in Spain? Find all the answers to your questions arranging a meeting with us and make sure you are on the right side of the Laws in Spain in order to avoid problems in future.

We are here to make your life easier so you only have to worry about how to spend your time in Spain

Tax Advice

Come to visit us in:

Av. Federíco García Lorca, 53, 03178 Benijófar, Alicante

Call or WhatsApp us on:

Reviews from our clients!

TESTIMONIALS